Gullak Money

- Consumer App

- FinTech

Democratising wealth creation in India.

It’s no secret that Indians have a strong culture of saving money. However, a sizable number of people save badly and inefficiently, resulting in them actually losing money over time. We’ve thus invested in Gullak Money to fix this unfortunate reality.

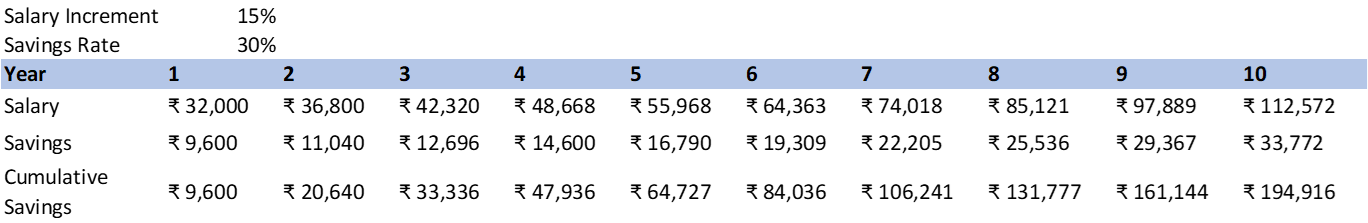

Let’s set the stage here: Imagine any typical worker earning the ₹32,000 per month (the average salary in India) who aims to save up for a house. Assuming a conservative savings rate of 30% — much higher than the model savings rate of 20% — this would lead to monthly savings of ₹9,600.

Again, assuming an ambitious salary increase of 15% yearly (much higher than India’s average of 10.6%), their savings journey can be plotted out below:

They’ll take the first 7 years to reach ₹1 lakh and end up with slightly below ₹2 lakhs by the 10th year.

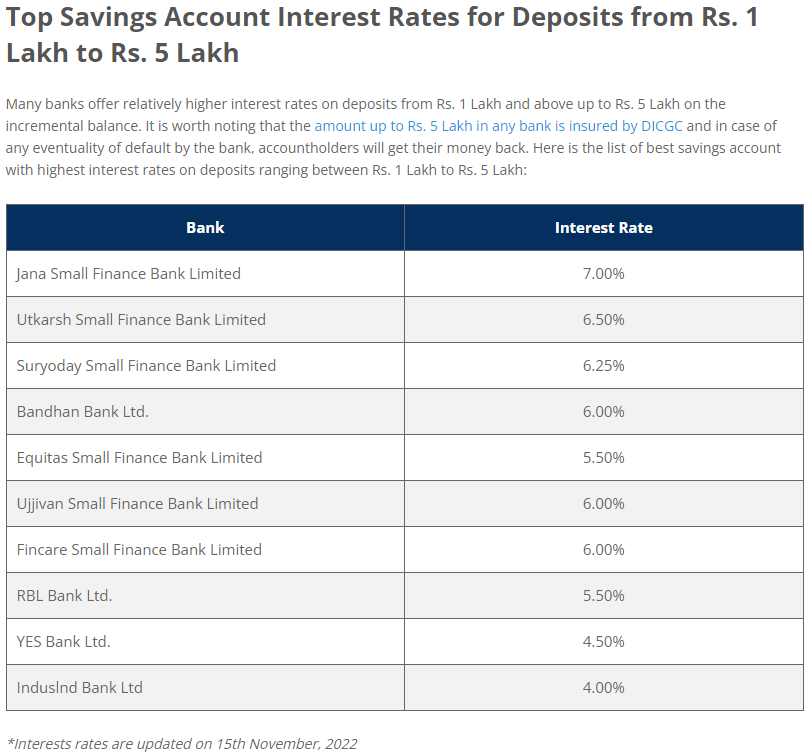

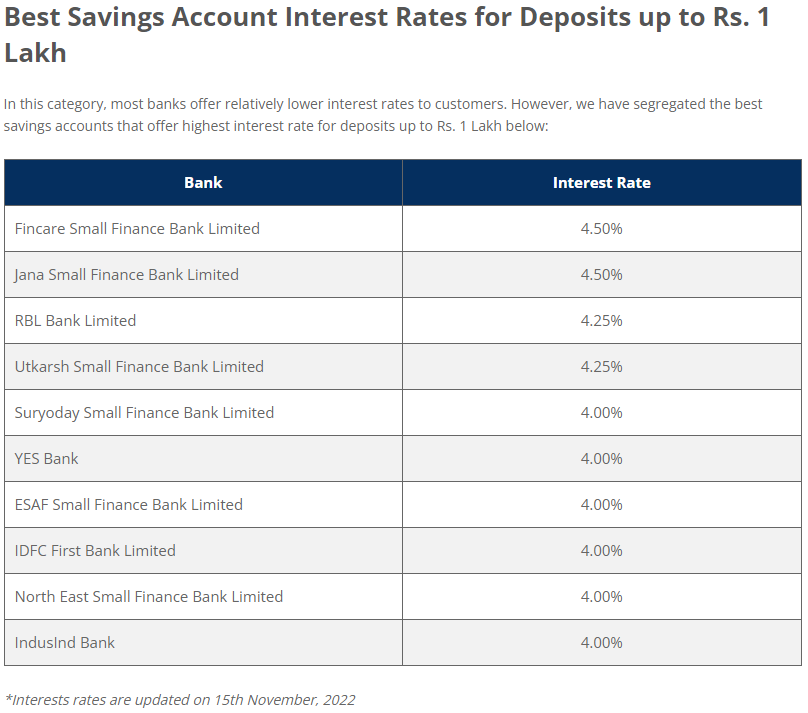

A quick look around at the savings accounts offered by various banks show annual interest ranging from 4.5% to 4% for deposits under ₹1 lakh, which they’re restricted to for the first 7 years. For the next 3 years, they can upgrade to a savings account offering 4% — 7% annual interest for ₹1 lakh — ₹5 lakh deposits.

Source: 10 Best Savings Account Interest Rate for 2022 in India (Updated) (paisabazaar.com)

At first glance, it may look like they’re earning a decent interest on the savings — until you realise that India’s inflation rate reached a high of 7.8% in April 2022 and typically hovers around 7%.

Additionally, it is also sobering to remember that the above savings scenario only applies to a fortunate individual who has the ability to save 30% of their income and receive yearly salary increases of 15%. They have also been spared from any unforeseen expenses, such as medical bills or wedding costs. This means that, in reality, the finances of many Indians are in a far more dismal state than the example provided. Not only is their hard-earned money being eroded by inflation on a daily basis, but they also save far less than expected.

It makes for some chilling statistics: in a poll of 3,220 people from 28 cities done, 90% of respondents above 50 years old regret not saving sooner, 59% believe their savings will not last for 10 years of retirement, and 23% do not know where to even begin to save for retirement. If this is reflective of the population, we’re talking about a massive 300 million people who have no idea of how to even start saving. Something needs to change — we need a savings portal that is easy to onboard, intuitive, and provides familiarity and trust for Indians to put their money into.

Amidst this alarming reality, we are excited to announce our participation in the Seed round of Gullak Money, the digital gold savings app that allows any serious Indian saver to begin their own efficient savings journey. By automating savings and investing them into 24K gold, Gullak allows users to save small amounts regularly through daily/monthly savings plans from as low as ₹10 per day. Users may also save spare change by rounding up their daily transactions to the nearest tens and automatically investing the change in gold. The ease of set-up in less than 30 seconds transforms the wealth creation journey into an extremely easy process with a mere few steps, while allowing users to retain full control over their funds — they may pause their savings anytime, withdraw their savings, or set savings goals to encourage themselves more. Gold also serves as a perfect savings instrument, being a much-beloved metal that holds cultural and economic significance in India.

Founded by Manthan Shah, Dilip Jain, and Naimisha Rao, this talented team of former Juspay executives and the former head of growth marketing at Twin Health aspires to improve Indian savings through the use of technology. Manthan and Dilip were part of the core team at Juspay for 7 years and were instrumental in building the FinTech infrastructure used by millions today, including BHIM UPI for the Indian government and the India stack, while Naimisha handcrafted the Sequoia-backed Series C company Twin Health’s growth strategy and contributed towards 80% of revenue then. With their technical expertise and agility, we believe this talented team is well-equipped to develop and introduce a new and much- improved savings experience for consumers.

We have full faith in this team and their ability to create a future where Gullak Money becomes the go-to gullak for Indians, helping to make the financial dreams of billions of people a reality. Through its efficient and user-friendly platform, Gullak Money has the power to bring an end to the outdated and ineffective savings methods of the past. We eagerly anticipate seeing Indians across the country have a better and firmer grasp of their financial future.

Corporate Info

- Entity Name

- Finternet Technologies Private Limited

- Founded Year

- 2022

- HQ Jurisdiction

- Delaware, US

- Director(s)

- Manthan Shah (CPO), Dilip Jain (CTO), Naimisha Rao (CGO)

Media Coverage

- January 19, 2023

- Saving and investment app Gullak raises $3M

TRTL’s website.

To Investors

We are currently in the midst of raising our fund. If you are interested in our thesis and want to embark on this journey with us, let’s discuss through an introduction at

To Entrepreneurs

If you are interested in working with us, we will be happy to work on the opportunity together. Please send us your pitch deck or business summary here at .

It’d be great if you can tell us everything about your business for us to make quick contact, should interest arise.